Cash vs. Accrual Accounting: Converting Cash to Accrual

While US GAAP dictates that accrual accounting is the appropriate method of accounting for external purposes, there may be times when you run into a scenario where the bookkeeper is using cash accounting and have to convert the data into accrual accounting information. See below for an explanation on how cash basis information can be converted into accrual basis information.

Read

Overview

At times it may be necessary for an accountant to convert a company’s cash basis accounting to the accrual basis and vice versa. This can be for tax reasons, adherence to US GAAP for external reporting, and other reasons.

A vital part of understanding how to convert cash basis figures to accrual basis figures is by understanding the difference between cash accounting and accrual accounting. If you would like an overview of these two accounting mindsets, click here.

There are a few different ways of tackling a cash to accrual or an accrual to cash conversion problem. If you simply want to tackle the problem and move on, formulas may work well for you. If you truly want to understand and master the concept, using t-accounts to analyze the situation is recommended along with the formula method.

For each of the scenarios below, I will include both methods. As a note before we get started, one of the most important assumptions to make when attempting to use t-accounts to convert is that all cash transactions run through a permanent account before they are recorded as their related expense or revenue.

Cash to Accrual Example: Sales

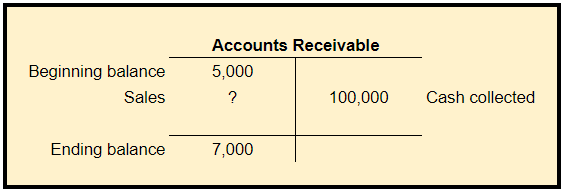

| Accounts receivable, beginning balance | $5,000 |

| Accounts receivable, ending balance | $7,000 |

| Cash sales collected during the year | $100,000 |

To convert cash sales to accrual sales, we must first analyze the situation. In this scenario, we are making the assumption that every sale runs through accounts receivable first before it is collected.

It is useful to think about what event makes accounts receivable increase and decrease.

Accounts receivable increases when we record sales.

Accounts receivable decreases when we make collections on the account.

Formula Method

Beginning accounts receivable + accrual sales – cash collections on account = ending accounts receivable

$5,000 + ? – $100,000 = $7,000

Solving for the unknown, we find that the amount of accrual sales is $102,000.

T-Account Method

Solve for the missing piece. In this t-account, we would need a $102,000 debit to make the t-account balance. Notice that the missing debit means that there was a credit to sales of $102,000. There is our accrual sales!

Cash to Accrual Example: Wages

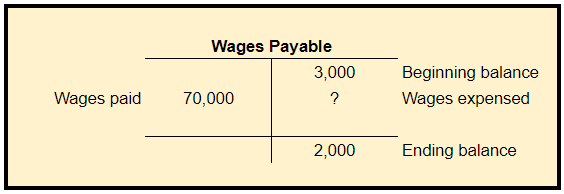

| Wages payable, beginning balance | $3,000 |

| Wages payable, ending balance | $2,000 |

| Amount paid for wages during the year | $70,000 |

To convert cash wages to accrual wages expense, first analyze the situation. In this scenario, we are making the assumption that every wage expense incurred runs through wages payable before it is paid.

It is useful to think about what event makes wages payable increase and decrease.

Wages payable increases when we expense wages.

Wages payable decreases when we pay our employees.

Formula Method

Beginning wages payable + wages expense – wages paid = ending wages payable

$3,000 + ? – $70,000 = $2,000

Solving for the unknown, we find that the amount of wages expense is $69,000.

T-Account Method

Solve for the missing piece. In this t-account, we would need a $69,000 credit to make the t-account balance. Notice that the missing credit means that there was a $69,000 debit to wages expense.

Watch

Click here to access the

Cash to Accrual Conversion Spreadsheet

and follow along!

Test Your Understanding

Congratulations!

It looks like you’ve mastered this lesson. Click here to return to the Cash vs. Accrual main page!