Estimating Costs: High-Low Method

The high-low method is a cost estimation technique used in managerial accounting to estimate fixed and variable costs based on high and low activity levels within a given period. This method involves selecting the highest and lowest activity levels and their corresponding costs, calculating the variable cost per unit by finding the difference in total costs between the high and low points, and then using this information to estimate total costs at different activity levels. While the high-low method is quick and easy to apply, it is not considered the most accurate cost estimation method, as it assumes a linear relationship between costs and activity levels, which may not always be the case in real-world scenarios.

Read

Using the High-Low Method to Estimate Variable Cost Per Unit

To use the high-low method to estimate the variable cost per unit, follow these steps:

1. Identify High and Low Activity Levels: Review your historical data and identify the period with the highest and lowest levels of activity (e.g., production units, machine hours, or other relevant measure) and their corresponding total costs.

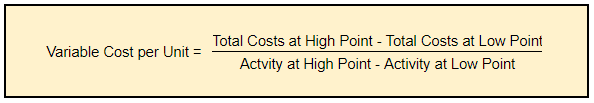

2. Calculate Variable Cost: Find the difference in total costs between the high and low activity levels using the formula below.

Estimating Fixed Costs

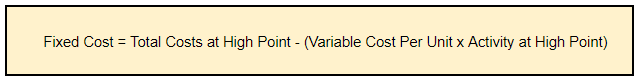

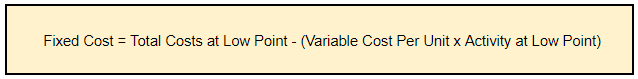

Once you have the variable cost per unit, you can use it to separate variable and fixed costs. The formula is:

OR

Whether you use the high point or the low point, the fixed costs calculated should be the same(1).

(1) Except in the event that the variable cost per unit was rounded.

Watch

Practice

Let’s see you apply what you’ve learned!

Test Your Understanding

Congratulations!

It looks like you’ve mastered this lesson. Click here to return to the Main Page.