Partnership Liquidation Charts

A partnership liquidation chart is a tool used to demonstrate the steps in the partnership liquidation process. There are a few major scenarios that learners, as well as accountants, should be aware of when tackling a partnership liquidation chart.

Read

1) The sale of the noncash assets: gain or loss?

When the company is selling of their noncash assets, it is likely that a gain or loss will arise. Any gain or loss should be allocated to the partners according to their profit/loss sharing ratio.

Example: XYZ Partnership has $20,000 in noncash assets. During liquidation, these assets were sold for $30,000. Partners X, Y, and Z have a profit loss sharing ratio of 1:3:1, respectively.

The first step, is to determine if we have a gain or a loss. In this case, we sold $20,000 of assets for $30,000, so we have a $10,000 gain.

Now that we know that we have a $10,000 gain, our next step will be to decide how much of this gain will be distributed to Partner X, Partner Y, and Partner Z. We will do this according to the partners’ profit/loss sharing ratio.

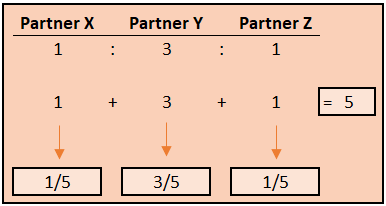

The profit/loss sharing ratio of 1:3:1 essentially tells us that we have 5 parts, and we can use this to create a fraction. Partner X will absorb 1/5 of the loss. Partner Y will absorb 3/5 of the loss, and Partner Z will absorb 1/5 of the loss.

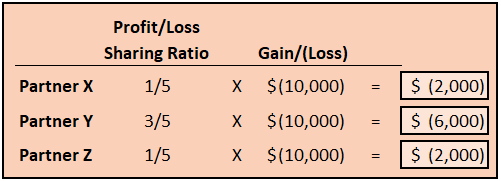

When we apply these fractions to the loss, we see that Partner X will absorb $2,000 of the loss, Partner Y will absorb $6,000 of the loss, and Partner Z will absorb $2,000 of the loss.

Image 3

2) Partner Deficit: Cash Contribution or Absorbed by the Remaining Partners

In certain partnership liquidations, there may be times when one (or more) of the partners have a negative balance. If a partner has a negative balance there are two possibilities on how it is handled. 1) The deficient partner contributes enough cash to bring his capital balance to zero, or 2) the remaining partners absorb the deficient partner’s negative balance.

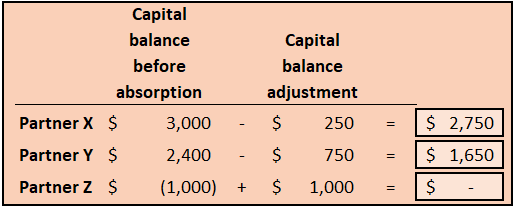

Example: After selling all noncash assets and paying off the partnership’s liabilities, the partner’s of XYZ Partnership have the following balances:

Partner X: $3,000

Partner Y: $2,400

Partner Z: $(1,000)

Assume that Partners X, Y, and Z, use a profit/loss sharing ratio of 1:3:1, respectively.

Option #1: The deficient partner contributes cash to the partnership to bring his/her balance to zero.

In this scenario, Partner Z would pay $1,000 directly to the partnership, which would increase the partnership’s cash by $1,000 and Partner Z’s capital balance by $1,000, which would solve the issue. Cash is then distributed to the remaining partners, X and Y, according to their capital balances.

Option 2: The remaining partners absorb the deficient partner’s negative balance.

In this scenario, Partner Z likely does not have the cash to make up his negative balance. In this case, Partners X and Y will absorb his $1,000 deficit according to their part of the profit loss sharing ratio.

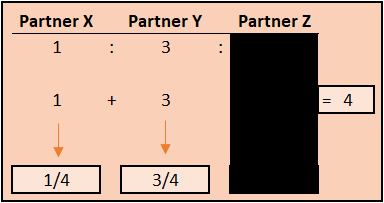

Recall that the profit/loss sharing ratio for Partners X, Y, and Z are 1:3:1. However, in this case, Partner Z has a negative balance, so we will ignore his portion of the ratio.

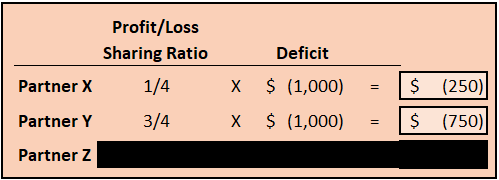

With this new ratio, we see that Partner X will absorb 1/4 of Partner Z’s deficit, and Partner Y will absorb 3/4 of Partner Z’s deficit.

As a result, Partner X’s and Y’s capital balances will decrease by the amount absorbed (decreasing the amount of cash they will receive in the cash distribution at the end), and Partner Z’s balance will be brought to zero.

Watch

Example #1

Example #2

Practice

Let’s see if you can apply what you’ve learned! Try the practice problem below.

Partnership Liquidation Chart #1

Test Your Understanding

Congratulations!

It looks like you’ve mastered this lesson. Good work!