Applying Manufacturing Overhead Using a Plantwide Overhead Rate

Prerequisites:

Prior to starting this lesson, you should have a strong understanding of manufacturing overhead. (See Product Costs vs. Period Costs)

When attempting to cost a product we are manufacturing, direct materials and direct labor are easy to handle because these costs are directly traceable to the product. Manufacturing overhead costs–such as factory rent, factory cleaning supplies, the factory supervisor’s salary–are more complicated because we cannot trace these costs to each unit being produced. Therefore, we must use a method to apply/allocate these costs to the units produced during a period.

One of the most basic methods is allocating using a plantwide overhead rate (this is sometimes referred to as a predetermined overhead rate). There are a few steps involved in this process:

- At the beginning of the year, the accountant calculates a plant-wide overhead rate. To do this a few things must be determined and estimated:

- The accountant must estimate the total overhead costs for the year.

- The accountant must determine a cost driver (sometimes referred to as an allocation base) that most closely determines how much overhead is used by each unit produced. Most textbooks use direct labor hours as a cost driver to overhead.

- The accountant must estimate the total of the cost driver for the year.

- The accountant applies overhead to production on the actual amount of the cost driver that was used each period. Therefore, the more direct labor hours that are used manufacturing a product during a period, the more overhead that will be applied during that period.

Let’s Apply It!

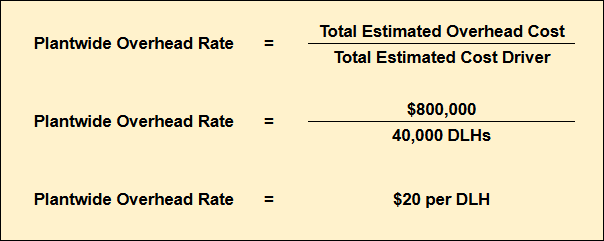

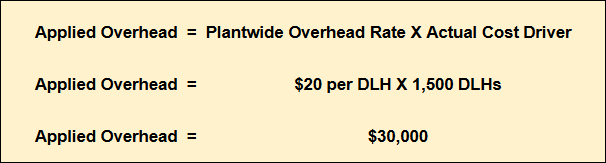

At the beginning of the year, we estimate that a company is going to have $800,000 in manufacturing overhead costs during the entirety of the year. We decide that direct labor hours (DLHs) used is the best cost driver to determine how much overhead to apply to each production, and we estimate that we will use 40,000 DLHs during the year. During the month of January, we use 1,500 DLHs in production.

- Calculate the plant-wide overhead rate.

2. Apply overhead based on actual usage of the cost driver.

You have completed this lesson! Ready to try Process Costing?