Product vs. Period Costs

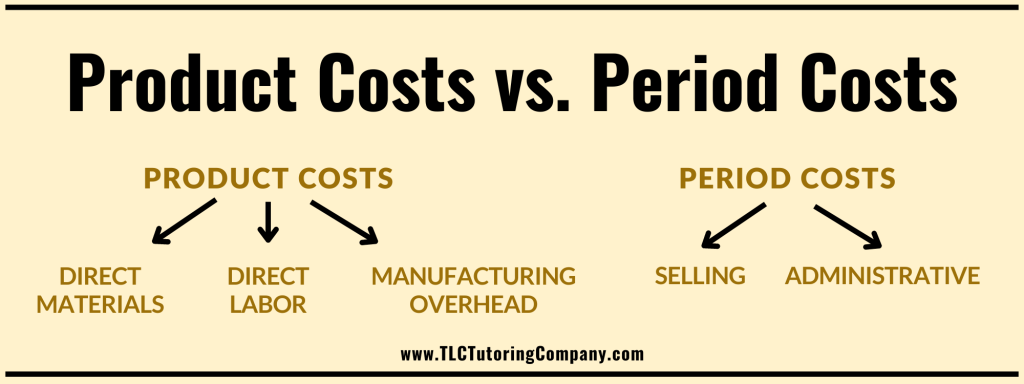

Understanding the distinction between product costs and period costs is fundamental in cost accounting, as it helps businesses accurately track expenses and evaluate financial performance. These two cost categories are critical for allocating expenses between production-related activities and general business operations.

Product Costs: These are the expenses directly associated with producing goods, such as raw materials, labor, and manufacturing overhead. Initially recorded as inventory on the balance sheet, they shift to the cost of goods sold (COGS) once the products are sold.

Period Costs: In contrast, period costs are expenditures unrelated to the production process, like selling and administrative costs. These are expensed during the period in which they occur, directly impacting the income statement.

In cost accounting, product costs refer to all expenses directly associated with manufacturing a product. These costs are crucial because they form the basis for determining the cost of goods sold (COGS) and, ultimately, profitability. There are three primary components of product costs: direct materials, direct labor, and manufacturing overhead.

- Direct materials are the raw materials that go directly into the production of goods. For example, steel used to manufacture automobiles is a direct material cost. These costs can be directly traced to the product being manufactured.

- Direct labor refers to the wages paid to workers who are directly involved in manufacturing the product, such as assembly line workers or machine operators.

- Manufacturing overhead includes all the indirect costs associated with production, such as utilities, factory maintenance, and equipment depreciation.

Watch

Apologies in advance for the recording marks.

Test Your Understanding

Congratulations!

It looks like you’ve mastered this lesson. Good work!